The Federal Budget 2024-25

The 2024 Federal Budget has been released, and we have compiled all of the key information passed down by Treasurer, Jim Chalmers. The budget promises cost-of-living relief without fuelling inflation while trying to reshape the economy with its Future Made in Australia industry package.

The Budget forecasts a surplus of $9.3 billion in 2023-24 (the current financial year), to be followed by deficits of $28.3 billion in 2024-25 and $42.8 billion in 2025-26. The larger deficit is driven by the Government’s cost-of-living relief and addressing unavoidable spending including terminating health funding and frontline services. From tax reforms to healthcare initiatives, explore what’s relevant to you.

Business Owners

Budget takeaways for business owners

Temporary $20,000 instant asset write-off threshold

The Government announced it will extend the small business $20,000 instant asset write-off (IAWO) by 12 months until 30 June 2025.

Currently, small business entities with an aggregated turnover of less than $10 million can immediately deduct the total cost of eligible depreciating assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

There is currently a bill which proposes increasing the IAWO threshold from $20,000 to $30,000 for the 2023-24 income year only. The bill was amended in the Senate on 27 March 2024 however, it has not received a royal assent and it is not yet law.

$325 Energy Bill Relief for small business – from 1 July 2024

The Government announced it will provide a $325 rebate to eligible small businesses. The rebate will apply as an automatic quarterly credit to energy bills.

Individuals and Families

Budget takeaways for individuals and families

Stage 3 Tax cuts confirmed starting from 1 July 2024

This is a key element of the Budget. Stage 3 Tax Cuts will be applicable from 1 July 2024 changing the tax brackets and rates for individual taxpayers.

The changes cut the bottom tax rate which applies to incomes below $45,000, from 19 per cent to 16 per cent. That will give a tax cut of up to $804 a year to all taxpayers, including those on higher incomes. At the same time Stage 3 tax cuts for higher earners are reduced. 30 per cent rate will apply to incomes between $45,000 and $135,000. The existing 37 per cent rate applies to incomes between $135,000 and $190,000. And the top rate of 45 per cent will remain for incomes above $190,000.

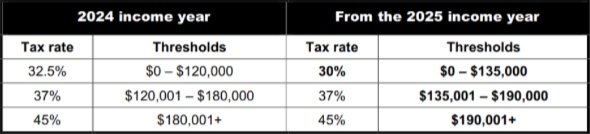

Updated tax rates are set out in the following tables:

Australian resident individual income tax rates:

Foreign resident individual income tax rates:

Increase of low-income thresholds for Medicare Levy

The Government will increase the Medicare levy low-income thresholds for singles, families, and seniors and pensioners from 1 July 2023.

The increase to the thresholds accounts for recent annual CPI outcomes and ensures that low income individuals continue to be exempt from paying the Medicare levy or pay a reduced levy rate.

The thresholds will be increased as follows:

For singles — from $24,276 to $26,000;

For families — from $40,939 to $43,846;

For single seniors and pensioners — from $38,365 to $41,089; and

For family seniors and pensioners — from $53,406 to $57,198.

For each dependent child or student, the family income thresholds will increase by a further $4,027 ($3,760 for 2021–22).

Superannuation on paid parental leave – starting 1 July 2025

The Government announced that superannuation will be paid on Paid Parental Leave payments starting from 1 July 2025.

Eligible parents will receive an additional payment based on the Superannuation Guarantee (12% of their PPL payments) as a contribution to their superannuation fund.

This measure builds on the October Federal Budget 2022–23 in which it increases the paid parental leave to 26 weeks by 2026.

Paid parental leave will increase to 22 weeks from July 2024, 24 weeks from July 2025 and 26 weeks from July 2026.

Foreign resident CGT regime

The Government will strengthen the foreign resident CGT regime.

The amendments will apply to CGT events commencing on or after 1 July 2025 to:

clarify and broaden the types of assets that foreign residents are subject to CGT on;

amend the point-in-time principal asset test to a 365-day testing period; and

require foreign residents disposing of shares and other membership interests exceeding $20 million in value to notify the ATO, prior to the transaction being executed.

This measure will ensure that Australia can tax foreign residents on direct and indirect sales of assets with a close economic connection to Australian land, more in line with the tax treatment that already applies to Australian residents.

The new ATO notification process will improve oversight and compliance with the foreign resident CGT withholding rules, where a vendor self-assesses their sale is not taxable real property.

$300 Energy Bill Relief for households – from 1 July 2024

The Government announced it will provide a $300 rebate to all Australian households. The rebate will apply as an automatic quarterly credit to energy bills.

Limiting Indexation of Higher Education Loan Program (HELP)

The Government announced that it will limit the indexation of the Higher Education Loan Program (HELP) and other student loans for the first stage of reforms to Australia’s tertiary education system in response to the Australian University Accord Final Report.

Under the proposed measure, the HELP debt indexation formula will be reformed so that the indexation rate would be the lower of the consumer price index (CPI) or the wage price index (WPI) in a given year. This is intended to replace the current indexation formula that is based on CPI and will apply to all HELP, VET Student Loans, Australian Apprenticeship Support Loans and other student support loan accounts that existed on 1 June 2023.

This measure is proposed to be backdated and applied from 1 June 2023 onwards.

This means that the indexation rate of 7.1% applied on 1 June 2023 would be reduced to 3.2% and the indexation rate to be applied on 1 June 2024 of 4.7% would be reduced to 4%.

An individual with an average HELP debt of $26,500 will see around $1,200 wiped from their outstanding HELP loans under the proposed measure.

Unsure how the 2024-25 Federal Budget will affect you?

Contact our JY Accountants team today!